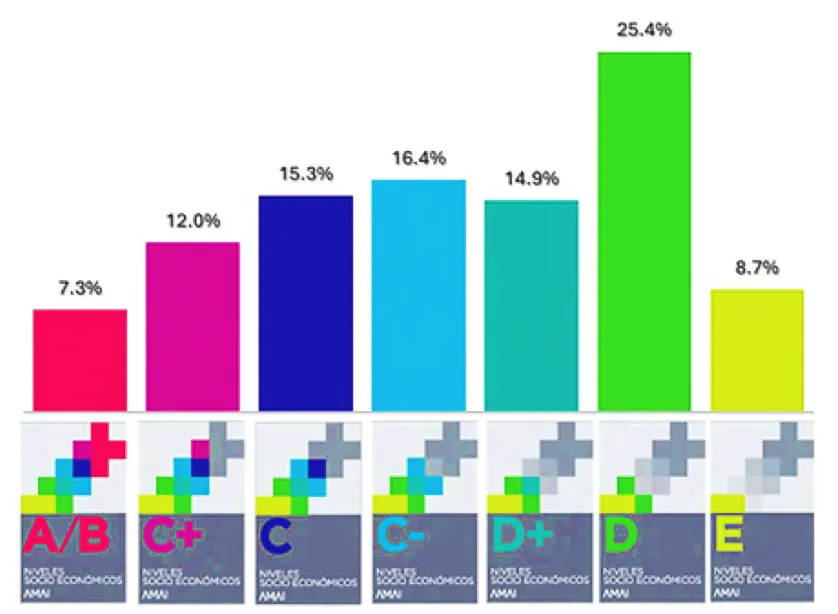

Purchasing Power

Discover insights about purchasing power and their relevance in today's dynamic business environment.

According to the National Survey on Financial Health (ENSAFI) 2024, the average monthly income needed to cover basic expenses in Mexico is 16,421 pesos. However, this figure varies significantly by region. For example, in Mexico City an average of 29,500 pesos is required, while in Chiapas it is estimated that 7,000 pesos is enough to live decently.

The

Buying an apartment or a house, for example, seems like an impossible mission. And only 3.6% of the economically active population who also have job stability have the capacity to afford it. This is because the terms to pay off these loans can take up to 20 years.

The challenges these people face are several, and the situation is complicated when observing the level of income that financial institutions request as a “minimum” to grant a loan.

The monthly payments range between 18,000 and 20,000 pesos and the loan term is 20 years, according to a bank loan application with Cofinavit HSBC, Cofinavit Hipoteca Cero Banorte, or Cofinavit Hipoteca Free Santander.

In addition, another situation that can hinder the purchase of an apartment is the down payment that reaches, at a minimum, an amount of 150,000 pesos.

More Articles

Sheinbaum to Visit Jalisco for Energy Project: The Strategy Behind the Investment

Jan 14, 2026

2026 World Cup to Elevate Cyberattack and Operational Disruption Risks for Businesses

Jan 12, 2026

Most Important Business News for Wednesday, January 28, 2026

Jan 28, 2026

How and Where to Leverage 2026 Property Tax Discounts in Aguascalientes

Jan 5, 2026

Formal Employment in Guanajuato 2025: Balance, Gaps, and Goals according to México ¿Cómo Vamos?

Jan 13, 2026

Carlos Slim Acquires 100% of Fieldwood Mexico

Jan 19, 2026