Guanajuato Achieves $15 Billion in Auto Parts Production, Solidifying Leadership in the Automotive Industry

Guanajuato's auto parts sector reaches $15 billion, cementing its role as a key player in the national and North American automotive supply chain.

With a production value of $15 billion in

, Guanajuato maintains its leadership in the sector, positioning itself as the second-largest producing state nationwide. This performance occurs amidst adjustments in the United States, its primary export market. The National Auto Parts Industry (INA) reported that Mexico accumulated $110.038 billion in production from January to November 2025. Although this figure represented a 2.86% year-on-year contraction, the sector demonstrated resilience during the second half of the year.

Mexico Leads US Market with 43.87% Share

Despite the US economic slowdown, Mexico solidified its position as the leading supplier of auto parts. During the January-November 2025 period, it achieved a record 43.87% share of US imports. Mexican exports totaled $95.725 billion, while imports reached $62.831 billion. Consequently, the country recorded a favorable trade balance of $32.893 billion. The United States accounted for 86.9% of Mexico’s auto parts exports. Canada contributed 3.2%, followed by Brazil with 1.1% and China with 1.6%.

US Adjustments Impact Production, Yet the Sector Remains Resilient

The sector’s performance was directly linked to US automotive production. From January to November 2025, the United States manufactured 9,366,461 vehicles, representing a 1.67% year-on-year decline. In November, the US market imported auto parts totaling $172.886 billion, a 3.10% decrease compared to the previous year. However, purchases from Mexico reached $75.851 billion, showing a smaller variation of -1.85%. These data indicate that Mexico cushioned the external slowdown and maintained stability in its value chain.

Guanajuato Ranks Second Nationally with 13.7% Share

In the state ranking, Coahuila led with $16.740 billion, equivalent to 15.3% of the national total. Guanajuato ranked second, producing $15.007 billion, with a 13.7% share. Nuevo León secured the third position with $14.366 billion, followed by Chihuahua with $9.609 billion and Querétaro with $8.610 billion. Collectively, the top ten states accounted for 86.9% of national production. The Bajío region contributed $39.429 billion, representing 35.9% of the national total. The Northern Zone led with 44%, while the Central Zone added 15.1%.

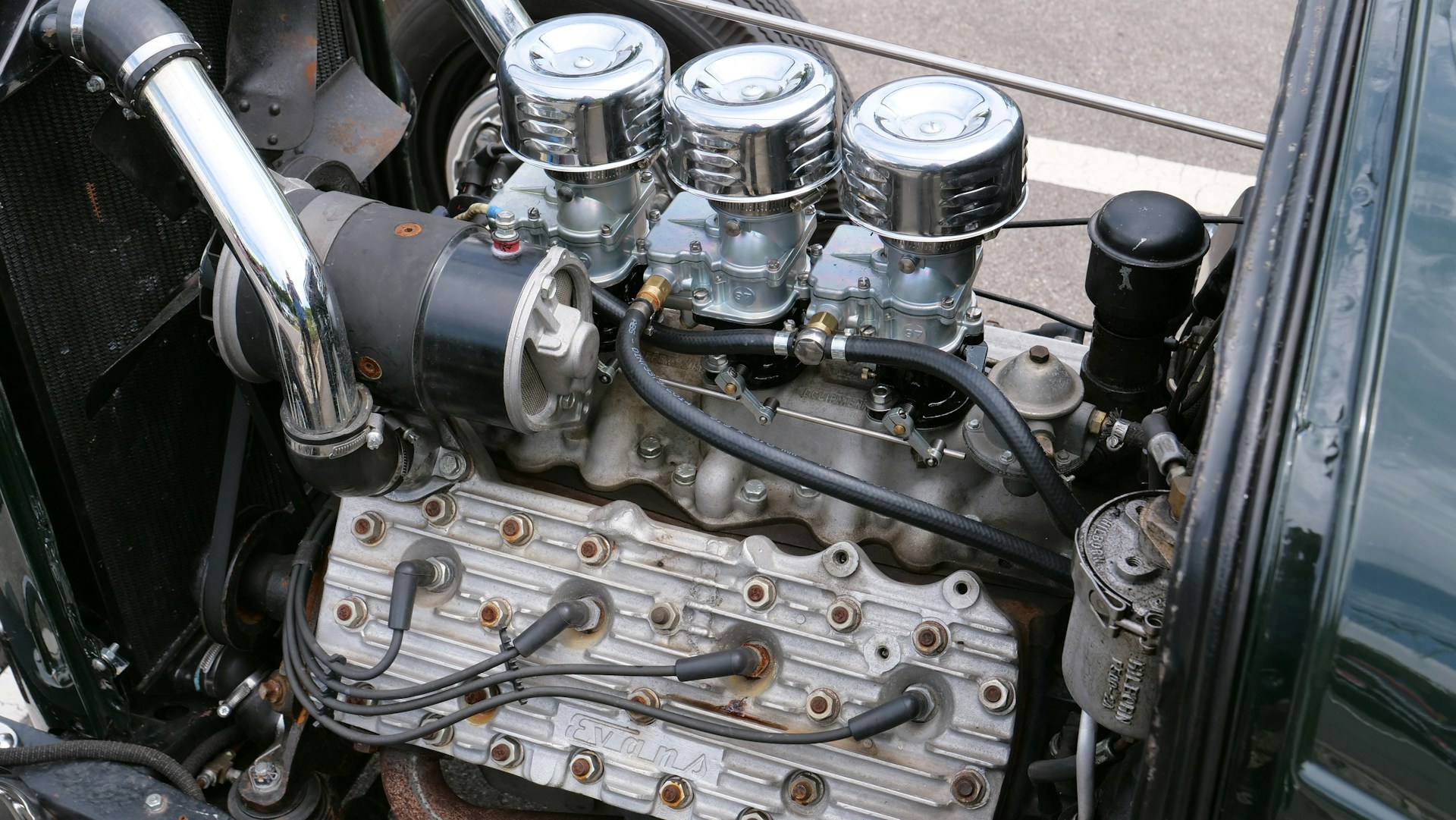

Five Segments Account for 53% of National Value

The production structure demonstrated high specialization. Electrical parts led with $21.221 billion, holding a 19.3% share. This was followed by transmissions and clutches with $10.821 billion (9.8%), fabrics and seats with $9.982 billion (9.1%), engine parts with $8.821 billion (8.0%), and suspension and steering with $7.367 billion (6.7%). These five groups collectively accounted for 53% of total production. As such, the sector maintains technological integration and advanced manufacturing capabilities.

Exports Represent 87% of National Production

Exports accounted for 87% of the sector’s total production. This indicator confirms the international orientation of Mexico’s auto parts industry. Furthermore, Mexico’s monthly share as a supplier to the United States reached 44.72% in November 2025. This figure reinforces its strategic position within the North American automotive supply chain. The INA highlighted that the performance in the second half of the year showed clear signs of recovery. The sector successfully adapted to external volatility and maintained competitive levels.

Guanajuato: Pillar of the Bajío Region and the Regional Automotive Supply Chain

Guanajuato’s performance strengthens the Bajío region as one of the country’s industrial engines. The state maintains integration with automotive assemblers and Tier 1 and Tier 2 suppliers. Furthermore, its strategic location facilitates logistics towards the United States. This advantage boosts exports and consolidates investments in advanced manufacturing. In a context of international slowdown, the state maintained its position. Thus, Guanajuato reaffirms its role as a key hub in Mexico’s auto parts production. The post

first appeared on Líder Empresarial.

More Articles

Guanajuato Brand Drives Over 147 Million MXN in Sales at the León State Fair 2026

Feb 9, 2026

Jalisco Highlights at FITUR 2026 in Madrid: Investments and Direct Flights

Jan 22, 2026

All Confirmed Strategic Investments and Projects in Nuevo León: January 2026

Jan 31, 2026

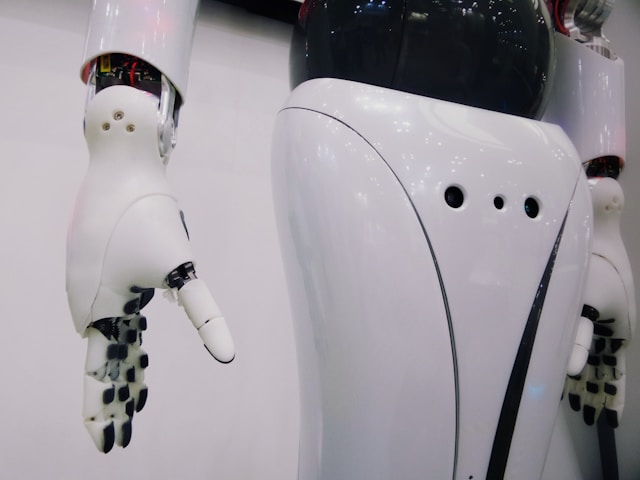

What Impact Will Reflex Robotics Have on Nuevo León's Economy?

Feb 3, 2026

Why Kia Chose Nuevo León to Manufacture the K4 Sportswagon

Jan 16, 2026

Guanajuato Leads Energy Transition with 428 MW of Clean Energy

Jan 26, 2026